The Business Research Company's report describes and explains the personal finance software industry from 2017 to 2022, referred to as the historic period, and 2022 to 2027, referred to as the forecast period, with additional forecasts from 2027 to 2032. This app features an achievement program that recognizes progress and encourages users to meet their short- and long-term financial goals by awarding badges that highlight positive financial growth, ultimately boosting users' confidence in their financial management skills.ġ) By Product Type: Web-Based Software, Mobile-Based SoftwareĢ) By Deployment Types: Cloud, On-Premiseģ) By End User: Small Businesses Users, Individual Consumers are continuously introducing new and advanced technologies, such as artificial intelligence, to enhance the effectiveness of personal finance management while minimizing the time and effort required.įor instance, Quicken, a leading personal finance management provider based in the US, launched Simplifi in August 2021. Key personal finance software market companies like Microsoft Corporation, Moneyspire Inc., PocketSmith Ltd., The Infinite Kind, Buxfer Inc. Innovation is a crucial trend in the market. Learn More In-Depth On The Personal Finance Software Market This highlights the increasing demand for secure and tailored digital services, which is driving the growth of the market. The Economist, a UK-based media outlet, reported that in 2022, 58% of banks across the globe relied on technology, such as artificial intelligence, to deliver personalized digital services.

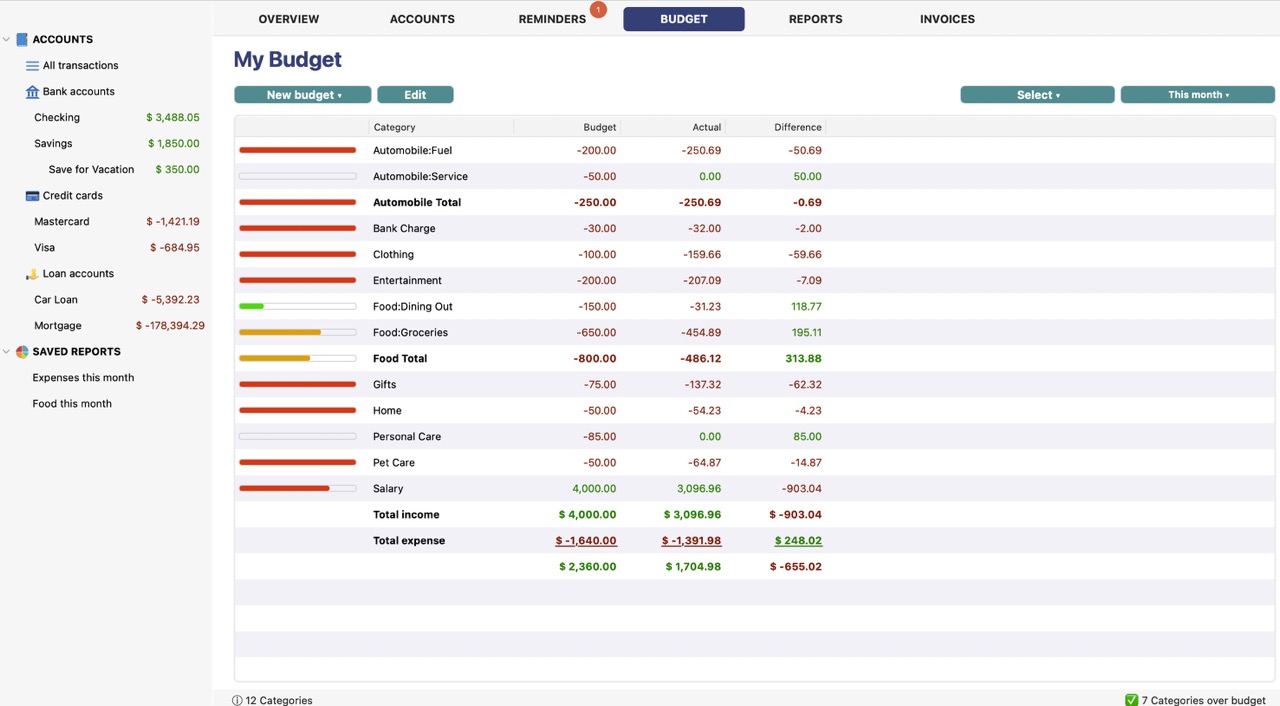

The personal finance software market is anticipated to expand due to the increasing need for personalized and secure digital services. North America region held the largest market share in 2022. Furthermore, it is anticipated that by 2027, the market size will reach $2.2 billion, growing at a CAGR of more than 6%. The personal finance software market size is expected to increase from $1.6 billion in 2022 to $1.7 billion in 2023, at a compound annual growth rate of more than 6%. LONDON, Ap(GLOBE NEWSWIRE) - As per the Business Research Company’s research on the global personal finance software market, the market is projected to grow significantly in the coming years. Moneyspire is a useful utility for all users that need help recording their incoming and outgoing money while also managing to better organize their expenses more efficiently.The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032 It will also let users issues reports where they can include details about their account and expenses, across various time spans and print it on paper if need be. The utility will offer users a variety of preset categories to justify their incoming and outgoing funds but they will still be able to add their own or modify the existing one for even more comfort, while also being able to manage multiple accounts of various types that are shown in a chart in the Overview section. The program will guide users through the basic procedures, like picking the currency they work with, setting the budget to the desired category, and will even help them even after they have gone through all the steps. Moneyspire is a handy utility that was is designed to help all users record their incoming and outgoing money. Moneyspire: Useful utility for helping you to manage your expenses.

0 kommentar(er)

0 kommentar(er)